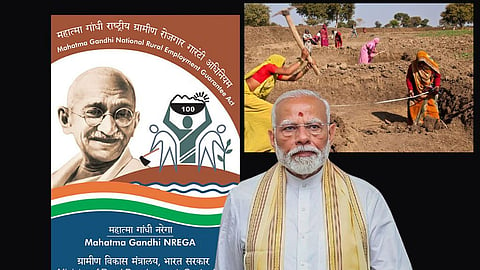

EXPLAINER | 5 key shifts | What is the VB–G RAM G Bill, 2025, and why is the govt replacing MGNREGA?

The NDA government’s proposed Viksit Bharat - Guarantee for Rozgar and Ajeevika Mission (Gramin) or VB-G Ram G Bill, 2025, seeks to expand assured wage employment for rural households from the current 100 days to 125 days in a financial year. The proposed increase, however, is expected to place additional fiscal pressure on state governments, as the Bill introduces a cost-sharing model for funding the programme. Significantly, the Bill also introduces a new provision allowing for a temporary suspension of guaranteed employment for up to 60 days in a year during peak agricultural periods such as sowing and harvesting, when work under the scheme will not be permitted. Once enacted, the VB-G Ram G Bill will replace the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), 2005.

The proposed legislation brings in five major changes to the existing rural employment guarantee framework:

1. Increase in guaranteed workdays

Under the VB-G Ram G Bill, every rural household with adult members willing to undertake unskilled manual labour will be entitled to 125 days of wage employment per year. This marks an increase from the 100-day guarantee under MGNREGA. While Section 3(1) of the existing MGNREGA Act mentions “not less than one hundred days” of work per household annually, in practice, 100 days has become the effective ceiling. This is largely because the NREGA management software does not allow work entries beyond 100 days unless states or Union Territories make special requests. At present, the Centre does permit up to 50 additional days of work in specific situations. For example, Scheduled Tribe households residing in forest areas are eligible for up to 150 days of employment if they do not own private land other than forest land recognised under the Forest Rights Act, 2016. Similarly, under Section 3(4) of MGNREGA, the government may authorise an extra 50 days of work in regions officially declared as drought-affected or hit by natural disasters, as notified by the Ministry of Home Affairs.

2. States to share wage costs with the Centre

A major departure from the existing framework lies in how the scheme will be financed. Unlike MGNREGS, where the Centre bears the full cost of unskilled wages, the VB-G Ram G Bill mandates states to share the wage expenditure. According to Section 22(2) of the Bill, the funding ratio will be 90:10 between the Centre and states for Northeastern states, Himalayan states, and certain Union Territories—Uttarakhand, Himachal Pradesh, and Jammu and Kashmir. For all other states and Union Territories with legislatures, the sharing formula will be 60:40. For Union Territories without legislatures, the Centre will continue to fund the scheme entirely. Under the current MGNREGA arrangement, the Centre covers wages for unskilled labour, up to 75% of material costs (including skilled and semi-skilled labour), and a portion of administrative expenses. States, on the other hand, bear the cost of unemployment allowances, 25% of material expenses, and administrative costs at the state level.

3. Introduction of ‘normative allocation’

The Bill replaces the open-ended labour budget system with a “normative allocation” approach. Section 4(5) empowers the Central Government to decide state-wise funding allocations annually based on objective criteria to be prescribed later. Any expenditure exceeding this allocated amount will have to be met by the respective state governments, as outlined in Section 4(6). The Bill defines normative allocation simply as the fund allocation made by the Centre to a state. This is a clear shift from the existing MGNREGA system, under which states submit annual labour budgets based on projected demand for work before the start of each financial year.

4. Suspension of work during peak farming seasons

To ensure sufficient availability of agricultural labour, the Bill allows for a temporary halt in scheme-related work during peak farming periods. Section 6(1) states that no work under the Act shall be initiated or carried out during peak agricultural seasons notified by state governments. States must declare, in advance, up to 60 days in a year—covering sowing and harvesting periods—when employment under the scheme will remain suspended. States may issue separate notifications for different regions, districts, blocks, or gram panchayats, depending on agro-climatic conditions and local farming practices. These notifications will be binding on all authorities responsible for planning and executing works under the scheme. While this provision addresses farmers’ concerns about labour shortages during crucial agricultural periods, it also effectively reduces the time window available for workers to avail the full 125-day employment guarantee.

5. Weekly wage payments without delay compensation clarity

The proposed law stipulates that wages must be paid weekly, tightening the payment timeline compared to MGNREGS, which allows up to 15 days. The Bill states that wages should be disbursed weekly or, at the latest, within a fortnight of the work being completed. Under MGNREGA, workers are entitled to compensation if wages are delayed beyond 15 days, calculated at 0.05% of unpaid wages for each day of delay after the sixteenth day. The VB-G Ram G Bill retains the same wage rates as those notified under MGNREGA and continues the provision for compensation in case of delayed payments, ensuring continuity on this front.

.png)